Why We Abandoned Apple's $10B Revenue Model for Something Better

Key Takeaways

- 1 Despite being UK's highest-grossing non-game app, strategic success meant reducing Apple App Store dependence for better margins

- 2 Apple's 30% platform fee and customer relationship constraints create unsustainable economics for premium content businesses at scale

- 3 Dual-channel strategy uses app stores for market validation while building direct subscriptions as primary revenue engine

- 4 Platform strategies should serve business objectives, not define them - build customer relationships independent of distribution mechanisms

The Times & Sunday Times iPad app holds an unusual distinction: it’s the highest-grossing non-game app in the UK App Store. Yet our most important strategic decision was deliberately reducing our dependence on Apple’s revenue-sharing ecosystem.

Platform Dependency vs. Revenue Control

While Apple’s App Store generated $10 billion in revenue during 2014 across 1.4 million apps, the mathematics reveal a concerning concentration risk. That’s an average of $7,100 per app annually - hardly a sustainable business foundation for serious content companies.

Our strategic analysis revealed three critical platform limitations:

Customer relationship constraints. Apple’s IAP model deliberately prevents direct customer communication beyond push notifications. For premium content businesses, customer relationship management represents the primary competitive moat. Surrendering this to platform intermediaries fundamentally weakens long-term positioning.

Revenue sharing economics. Apple’s 30% platform fee creates an immediate margin compression that becomes unsustainable at scale. For content businesses with existing production costs, platform fees can eliminate profitability entirely.

Market expansion limitations. App Store bundling functionality only applies to paid apps, which represent 4% of total applications. This architectural constraint prevents sophisticated revenue model experimentation.

Strategic Platform Arbitrage

Rather than optimising within platform constraints, we developed a dual-channel strategy that maximised the benefits of each approach:

App Stores as market validation tools. We leveraged Apple’s global distribution to test market demand across non-domestic territories including the US, Australia, Canada, Switzerland, and France. This provided invaluable market intelligence for international expansion decisions without requiring significant upfront investment.

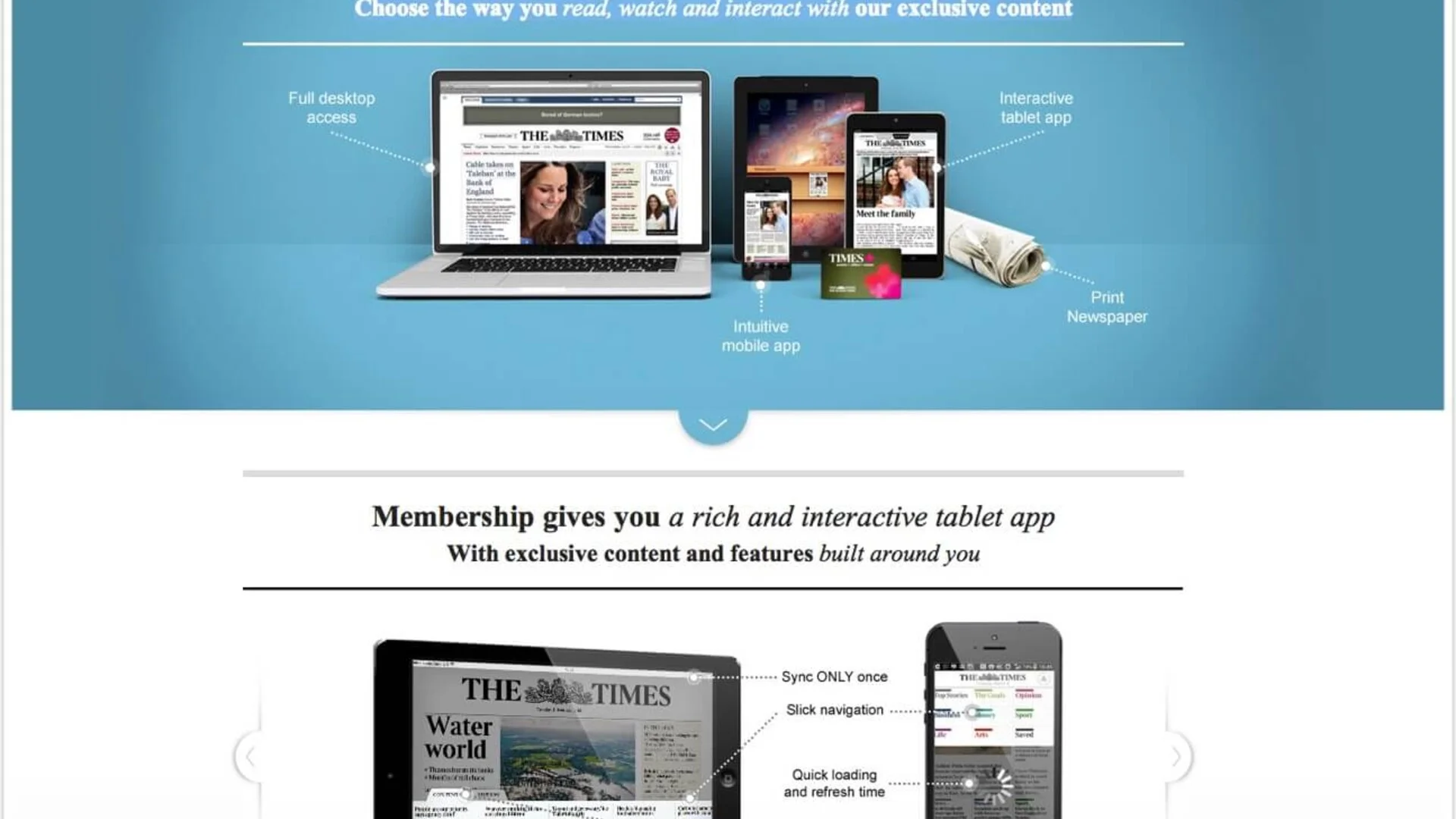

Direct subscriptions as primary revenue engine. Our direct subscription model offers customers integrated access across smartphone apps, tablet applications, web platforms, and exclusive membership benefits. This creates genuine value bundling rather than artificial platform restrictions.

Revenue Model Performance Comparison

The results validate our platform strategy approach. Despite falling from 5th to 8th position in Apple’s annual rankings, this reflects strategic success rather than market failure.

Position decline occurred due to:

- Freemium games improving in-app purchase optimisation

- Our deliberate revenue shift toward higher-margin direct subscriptions

Financial performance improved because direct subscription margins significantly exceed App Store revenue sharing arrangements. While specific figures remain confidential due to public company disclosure requirements, the strategic direction is clear.

Platform Economics for Executive Decision-Making

Our experience demonstrates three critical principles for platform strategy:

Platform leverage, not platform dependence. Use platform distribution capabilities for customer acquisition and market validation, but retain direct customer relationships for revenue optimisation.

Margin architecture drives sustainable growth. Platform fees that seem reasonable at startup scale become profit-destroying at enterprise scale. Plan revenue model transitions before platform dependency becomes financially constraining.

Customer value proposition differentiation. Direct subscription models allow value bundling that platforms actively prevent. This creates competitive advantages that platform-dependent competitors cannot replicate.

The Android Reality Check

Market data from Google Play reinforces our strategic approach. Google acknowledges that developers struggle to generate meaningful profit through their platform, with Android users demonstrating consistently lower willingness to pay for premium content.

The mobile platform landscape rewards different strategic approaches:

- Indies should maximise platform leverage through freemium IAP models

- Established content companies should use platforms for distribution while building direct customer relationships

- Enterprise applications require platform-independent revenue models from inception

Strategic Framework: Beyond Platform Optimisation

Monument Valley’s financial disclosure provides useful benchmarks for independent developers, but also highlights why platform strategies must differ based on organisational scale and objectives.

For content companies, the strategic imperative isn’t platform optimisation - it’s platform transcendence. Success requires building customer relationships that exist independently of any single distribution mechanism.

Our App Store Optimisation work continues, but as one component of a diversified customer acquisition strategy rather than the primary revenue foundation. This approach provides sustainable competitive positioning while maintaining platform relationship benefits.

The fundamental insight: Platform strategies should serve business objectives, not define them. When platforms become constraints rather than enablers, successful companies build alternative pathways to customer value creation.

Image courtesy of TNL