Key Takeaways

- 1 UK fashion eCommerce commands 29% of the £177bn market, with online penetration stabilised at 30% creating mature opportunities for differentiated technology solutions

- 2 Retailers implementing AI-powered personalisation achieve 28% conversion rate improvements and 34% customer acquisition cost reductions according to Deloitte analysis

- 3 73% of businesses currently use headless architecture, with 98% of non-users planning evaluation within 12 months—creating significant market velocity for infrastructure providers

- 4 B2B eCommerce projected to expand at 24.5% CAGR through 2030, outpacing B2C growth as 39% of buyers spend over $500,000 per order online

- 5 Fashion brands implementing headless commerce report 37% conversion rate increases and 26% average transaction revenue gains alongside 85% faster load times

Executive Summary

The UK eCommerce market reached £177 billion in 2024, with online penetration stabilising at approximately 30% of total retail sales. Fashion and apparel commands 29% of UK eCommerce revenue share, positioning the sector at the forefront of digital commerce innovation whilst creating substantial opportunities for technology startups that can address retailer pain points with differentiated solutions.

For founders building technology for global fashion retailers, this landscape presents a critical inflection point. McKinsey research indicates that AI-powered personalisation in retail can potentially create value ranging from £1.3 trillion to £2.3 trillion, whilst Deloitte’s analysis shows retailers implementing AI-powered marketing systems achieve 28% conversion rate improvements and 34% customer acquisition cost reductions. The B2B channel is projected to expand at 24.5% CAGR through 2030—significantly outpacing B2C growth—as corporate buyers migrate to self-service applications.

This article examines the strategic opportunities for startups across AI-driven personalisation, headless commerce infrastructure, B2B modernisation, sustainability enablement, and cross-border commerce facilitation. Understanding these current opportunities—and the specific pain points fashion retailers face—is essential for founders seeking to build venture-scale businesses in the fashion technology sector.

The Current State: Fashion Retail’s Digital Transformation Challenge

Market Maturity and Competitive Dynamics

The UK eCommerce market has entered a mature growth phase following post-pandemic normalisation. Online penetration plateaued at 30.4% in 2024, reflecting a structural shift in consumer behaviour rather than continued explosive growth. This maturity creates both challenges and opportunities for startups: whilst the land-grab phase of digital commerce has concluded, the optimisation and differentiation phase presents substantial opportunities for focused solutions.

Fashion and apparel retained a 29% revenue share in 2024, driven by the UK’s style-conscious consumer culture and the sector’s early digital adoption. However, high return volumes and promotional pressures temper net profitability—creating acute need for solutions that improve conversion, reduce returns, and enhance operational efficiency. Smartphones captured 55% of UK eCommerce transactions in 2024, with mobile commerce projected to reach approximately 60% by 2028, demanding mobile-first technical architectures.

The Technology Infrastructure Gap

Fashion retailers face a critical challenge: legacy technology platforms cannot support the pace of innovation required by modern consumers. Over six in ten retail companies planned to migrate to headless commerce platforms by 2024, whilst over 20% already use them. The drivers are clear:

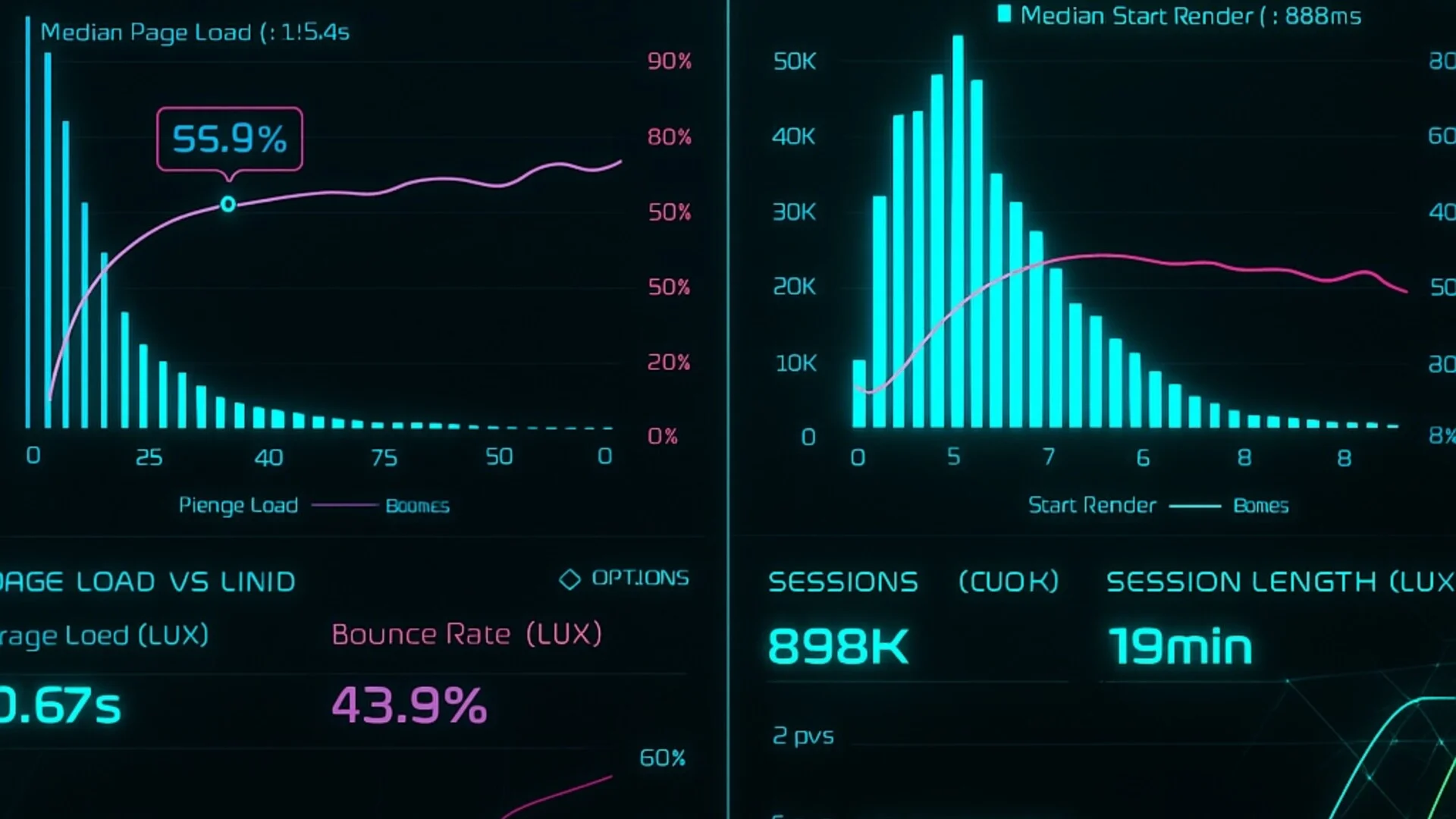

- Speed requirements: 57% of customers abandon websites if a page takes longer than three seconds to load

- Omnichannel expectations: More than 110 million people in the United States made purchases directly through social channels in 2024

- Personalisation demands: 66% of customers expect companies to understand their unique needs and preferences, yet only 34% believe companies actually do

- Mobile dominance: 60% of total web traffic comes from phones, with mobile shoppers representing an increasing share of conversions

Technology Impact: Headless commerce architecture—separating frontend presentation from backend systems via APIs—enables fashion retailers to deliver consistent omnichannel experiences, experiment rapidly with new customer touchpoints, and leverage modern frontend frameworks optimised for performance. British apparel brand White Stuff achieved 85% faster overall load times, doubled mobile speed, and delivered a 37% increase in conversion rates alongside a 26% increase in average transaction revenue after implementing headless architecture.

Business Impact: The global headless commerce market, valued at $1.74 billion in 2025, is projected to reach $7.16 billion by 2032, representing a 22.4% compound annual growth rate. Fashion retailers implementing headless architectures report 23% reductions in bounce rates, 20% decreases in website load times, and 25% increases in conversion rates. For startups, this represents a substantial and growing market opportunity—particularly for solutions that reduce implementation complexity and ongoing maintenance costs.

The Implementation Reality: Despite compelling benefits, headless commerce adoption faces significant barriers. Small and medium-sized retailers cite integration complexity, high development and maintenance costs, and the need for skilled technical teams as primary challenges. McKinsey indicates that technical debt accounts for nearly 40% of IT balance sheets, with retailers struggling when simple updates take days or longer, customer data is scattered across systems, and IT teams are consumed by maintenance rather than innovation. This creates opportunity for startups offering “headless-as-a-service” solutions that provide composable commerce benefits with reduced technical complexity.

Strategic Opportunities for Fashion Technology Startups

AI-Driven Personalisation: The New Competitive Requirement

Personalisation has evolved from competitive advantage to table stakes. 80% of consumers are more likely to purchase from brands delivering personalised content, whilst personalisation leaders are three times more likely to exceed revenue goals. For fashion retailers specifically, where product fit, style preference, and brand affinity drive purchasing decisions, AI-powered personalisation delivers measurable impact.

The Opportunity: Deloitte’s analysis shows retailers implementing AI-powered marketing systems achieve 34% customer acquisition cost reductions and 28% conversion rate improvements. AI-driven personalisation extends beyond recommendation engines to encompass:

- Dynamic pricing optimised for conversion and margin

- Predictive inventory allocation based on demand forecasting

- Personalised search results and product discovery

- Customer service automation with context-aware responses

- Size and fit recommendations reducing return rates

What Fashion Retailers Need: Solutions that integrate seamlessly with existing technology stacks, provide real-time personalisation without requiring complete platform replacement, and demonstrate clear ROI through A/B testing and controlled rollouts. McKinsey reports that companies systematically tracking AI impact in marketing see 20-30% higher campaign ROI than those that don’t, because they can continuously optimise based on measured results.

Startup Positioning: Focus on vertical-specific applications rather than generalised platforms. Fashion-specific AI solutions addressing size prediction, style matching, visual search, or returns reduction have clearer value propositions than horizontal personalisation engines. The e-commerce personalisation software market is experiencing substantial growth, offering significant room for focused players in the fashion vertical.

Headless Commerce and Composable Architecture

73% of all businesses currently use headless website architecture, whilst nearly 98% of those not currently using headless plan to evaluate solutions within the next 12 months. This creates extraordinary market velocity for startups offering headless commerce solutions, particularly those addressing implementation and maintenance pain points.

The Opportunity: Fashion retailers need headless architecture for several strategic reasons:

- Speed to market: 80% of organisations using headless architecture feel they’re ahead of competitors when delivering new digital experiences

- Scalability: 79% report improved ability to scale their operations

- Flexibility: 73% cite ability to customise digital experiences as the primary benefit

- Performance: Headless architectures requiring fewer server requests deliver measurably improved performance

Market Pain Points: Whilst benefits are clear, adoption barriers remain significant. Small and medium-sized enterprises find implementation difficult due to limited resources, whilst even larger retailers struggle with integration complexity and ongoing maintenance costs. Users express need for more plug-and-play solutions, better documentation, and unified analytics tools that seamlessly connect front-end and back-end systems.

Startup Positioning: Several approaches offer venture-scale opportunity:

- Frontend-as-a-Service: Pre-built, customisable storefronts that connect to existing backends via APIs, reducing implementation time from months to weeks

- Integration platforms: Middleware solutions that simplify connections between headless frontends and multiple backend systems

- Specialised frontend frameworks: Fashion-specific UI components and templates optimised for visual merchandising and product presentation

- Progressive Web App builders: Tools enabling retailers to deliver app-like mobile experiences without native app development costs

B2B Commerce Modernisation: The Underserved Opportunity

Whilst B2C transactions supplied 88% of UK eCommerce revenue in 2024, the B2B channel is projected to expand at a 24.5% CAGR through 2030 as corporate buyers migrate to self-service applications. McKinsey’s B2B Pulse Survey reveals that 39% of buyers now spend over $500,000 per order through self-service eCommerce or remote interactions—up from 28% two years ago. Critically, 73% are willing to spend $50,000 or more in a single online transaction, with 20% open to transactions exceeding $1 million.

The Opportunity: Fashion retailers with wholesale operations face a significant challenge—traditional B2B systems deliver experiences decades behind B2C standards. Buyers accustomed to Amazon-grade experiences in their personal lives expect similar functionality in professional purchasing. McKinsey data shows eCommerce has been ranked the most effective sales channel for B2B sellers for four consecutive years, yet most fashion wholesalers lack modern digital commerce capabilities.

What Fashion Retailers Need:

- Self-service portals with contract pricing and bulk ordering capabilities

- Integration with procurement systems and ERPs

- Sales representative masquerading functionality enabling remote support

- Flexible payment terms and credit management

- Mobile-optimised interfaces matching B2C experience standards

- Real-time inventory visibility across warehouses and distribution centres

Business Impact: The UK B2B eCommerce market, valued at approximately £688 billion in 2024, is projected to reach over £5.4 trillion by 2033—representing a 22.9% CAGR. Fashion wholesalers implementing modern B2B commerce report 15-25% increases in order values, 30-40% reductions in order processing costs, and improved customer retention as buyers shift spending from competitors with inferior digital experiences.

Startup Positioning: B2B commerce platforms specifically designed for fashion wholesale represent significant opportunity. Key differentiators include:

- Fashion-specific functionality (seasonal collections, pre-orders, made-to-order workflows)

- Visual merchandising tools for wholesale catalogues

- Showroom digitisation enabling virtual appointments

- Integration with fashion-specific ERPs and PLM systems

- Trade show and market week functionality

Sustainability Enablement: Technology for Conscious Commerce

McKinsey research in the UK reveals that approximately one-quarter of consumers actively seek sustainable options, with this group willing to pay 15% more for sustainable alternatives. More broadly, 67% of consumers consider a brand’s use of sustainable materials an important purchasing factor, whilst 63% consider a brand’s promotion of sustainability similarly important in their decision-making.

The Reality: Consumer sentiment exceeds behavioural change—surveys show higher sustainability concern than purchasing patterns demonstrate. However, BCG’s analysis shows 15-20 percentage point differences in consumer response levels between brands, indicating that execution quality matters significantly. Sustainability leaders command premium pricing and stronger loyalty when they demonstrate genuine environmental commitment through supply chain transparency and circular economy initiatives.

The Opportunity: Fashion retailers need technology infrastructure to deliver on sustainability commitments:

- Supply chain visibility: Blockchain or database solutions tracking materials from source to garment

- Carbon footprint calculators: Tools providing product-level environmental impact data

- Circular economy platforms: Resale, rental, and repair programme management systems

- Certification management: Systems tracking and displaying sustainability credentials

- Impact reporting: Dashboards aggregating environmental metrics for corporate reporting

Business Impact: Fashion brands that successfully communicate sustainability practices see measurably higher engagement. BCG research shows sustainability is already driving consumer action, influencing purchase decisions in the short term and brand perception over the longer term. Up to 70% of consumers are interested in what brands are doing on sustainability, though less than half feel well informed—creating opportunity for technology that bridges this information gap.

Startup Positioning: Vertical-specific sustainability solutions for fashion offer stronger positioning than horizontal platforms. Fashion’s unique challenges—complex global supply chains, fast product cycles, material diversity—require specialised approaches. Successful startups will demonstrate clear ROI through reduced returns (better product information), premium pricing support (verifiable sustainability claims), and regulatory compliance automation.

Social Commerce Integration: Platform-Native Selling

In 2024, more than 110 million people in the United States made purchases directly through social channels, representing a trend that is mirrored in the UK market. The UK follows similar adoption patterns, with TikTok Shop’s expansion and Instagram’s enhanced shopping capabilities creating new customer acquisition vectors. Deloitte survey data shows 68% of consumers now purchase products on social media more frequently.

The Opportunity: Fashion brands recognise social commerce importance but struggle with execution complexity:

- Inventory synchronisation across platforms

- Content creation at scale

- Creator relationship management

- Attribution and performance measurement

- Customer service across multiple channels

- Returns processing from social purchases

What Fashion Retailers Need: Unified platforms managing social commerce operations across Instagram, TikTok, Facebook, Pinterest, and emerging channels. Critical capabilities include real-time inventory management, creator marketplace functionality, content creation tools, performance analytics, and integrated customer service.

Business Impact: Fashion brands successfully executing social commerce strategies report 20-30% lower customer acquisition costs compared to traditional digital advertising, driven by authentic creator content and platform algorithms favouring native commerce experiences. However, success requires ongoing content operations investment and platform-specific expertise.

Startup Positioning: Several approaches offer venture-scale opportunity:

- Social commerce orchestration platforms: Unified dashboards managing inventory, orders, and content across social channels

- Creator marketplace solutions: Platforms connecting brands with fashion creators and managing collaboration workflows

- Content creation tools: AI-powered solutions generating platform-optimised product content

- Attribution and analytics: Multi-touch attribution models properly crediting social commerce impact

Cross-Border Commerce: Post-Brexit Complexity as Competitive Advantage

Cross-border trade comprises 12% of UK eCommerce orders, with apparel and footwear dominating outbound parcels, reflecting strong brand equity among EU consumers. Post-Brexit regulatory complexity creates both significant challenges and potential competitive moats for solutions that effectively navigate international commerce requirements.

The Opportunity: UK fashion brands seeking EU expansion face operational complexity that smaller retailers struggle to manage internally:

- Multi-currency pricing and payment processing

- Localised payment method support

- Customs documentation and duty calculation

- Landed cost transparency for customers

- Returns processing across borders

- VAT and tax compliance automation

Business Impact: Fashion retailers with sophisticated international commerce capabilities can access substantial market opportunity whilst many competitors retreat from complexity. Effective cross-border solutions enable 15-25% higher conversion rates in international markets through transparent pricing, local payment methods, and clear delivery expectations.

Startup Positioning: Solutions addressing post-Brexit specific challenges have strong positioning, particularly those offering:

- Automated customs documentation generation

- Real-time landed cost calculation

- VAT compliance automation for EU markets

- Localisation beyond translation (sizing standards, cultural adaptation)

- International returns optimisation

Conclusion: Building for Fashion Retail’s Digital Future

The UK fashion eCommerce market presents substantial opportunity for technology startups that deeply understand retailer pain points and deliver focused, differentiated solutions. With fashion commanding 29% of the £177 billion UK eCommerce market and technology adoption accelerating across AI personalisation, headless commerce, and B2B modernisation, multiple venture-scale opportunities exist for founders willing to specialise.

Success requires understanding that fashion retailers face unique challenges. High return rates demand solutions reducing sizing uncertainty and improving product representation. Fast product cycles require agile content creation and merchandising tools. Global supply chains need visibility and sustainability verification. Complex wholesale relationships require B2B commerce matching B2C experience standards.

For founders targeting this market, several principles guide successful positioning:

Vertical specialisation: Fashion-specific solutions command higher prices and face less competition than horizontal platforms. Deep understanding of fashion operations, seasonal cycles, and industry workflows creates defensible differentiation.

Integration simplicity: Fashion retailers are cautious about platform replacements following legacy system challenges. Solutions integrating seamlessly with existing technology stacks through APIs reduce adoption friction significantly.

Demonstrated ROI: Fashion retailers face margin pressure and need clear business cases. Solutions providing A/B testing, controlled rollouts, and transparent performance metrics accelerate purchasing decisions.

Operational excellence: Fashion retail is operationally complex. Solutions handling edge cases, supporting peak season scaling, and providing excellent support build lasting customer relationships.

Composable positioning: The shift toward composable commerce—assembling best-of-breed solutions rather than monolithic platforms—favours focused startups delivering specific capabilities exceptionally well.

The market timing is favourable. 73% of businesses currently use headless architecture, with 98% of non-users planning evaluation within 12 months. B2B commerce is projected to expand at 24.5% CAGR through 2030. Retailers implementing AI-powered personalisation achieve 28% conversion rate improvements. These data points demonstrate both market readiness and substantial opportunity for startups delivering differentiated value across AI personalisation, headless commerce, B2B modernisation, sustainability enablement, and cross-border commerce.

Fashion retailers that successfully navigate digital transformation—supported by innovative technology partners—will capture disproportionate value in an increasingly competitive landscape. For founders building these solutions, the opportunity to build venture-scale businesses addressing real pain points with measurable impact has never been more compelling.

Image courtesy of Unsplash

References

-

eMarketer. (2024). UK Ecommerce Forecast 2024.

-

Mordor Intelligence. (2025). UK E-commerce Market - Size & Growth Analysis Report, 2030.

-

McKinsey & Company. (2024). The Value of Personalization at Scale. Market Inspector UK.

-

McKinsey & Company. (2022). In Search of Fashion’s Sustainability Seekers.

-

Deloitte. (2024). AI in Retail & Consumer Products. Referenced in: Parab, G. U. (2024). AI-Driven Personalization in Retail Analytics. International Journal of Research in Computer Applications and Information Technology, 7(2), 2387–2396.

-

Deloitte. (2025). Marketing Trends 2025: Personalization, AI, and Growth Through Resilience.

-

Boston Consulting Group. (2022). Exploring UK Consumer Interest in Sustainability.

-

McKinsey & Company. (2020). Survey: Consumer Sentiment on Sustainability in Fashion.

-

Coherent Market Insights. (2025). Headless Commerce Market Size and YoY Growth Rate, 2025-2032.

-

Crystallize. (2024). Headless Commerce Trends and Innovations.

-

Crystallize. (2025). Essential Headless eCommerce Statistics for 2025.

-

BigCommerce. (2025). What Is Headless Commerce? A Guide for 2025 Success.

-

ConvertCart. (2024). 35 Brand Examples of Headless Commerce in 2025.

-

BigCommerce. (2025). Top B2B Ecommerce Trends to Transform Your Business in 2025.

-

McKinsey & Company. (2024). B2B Pulse Survey: Omnichannel Ecommerce Driving B2B Sales.

-

Straits Research. (2025). United Kingdom B2B eCommerce Market Size, Share & Trends Report by 2033.

-

Shopify. (2025). B2B Ecommerce Challenges in 2025: What Commerce Leaders Need To Know.

-

Shopify. (2025). B2B Ecommerce Trends 2025-2026: 15 Strategies Transforming Digital Commerce.

-

BigCommerce. (2025). Top Ecommerce Trends to Watch in 2025.

-

SAP Emarsys. (2025). 2025 Trends in E-Commerce Personalization.

-

Deloitte. (2024). Future of Retail: Profitable Growth Through Technology and AI.

-

PureNet. (2025). B2C and B2B Ecommerce Trends 2025.

-

McKinsey & Company. (2022). Becoming Indispensable: Moving Past E-commerce to NeXT Commerce.

-

Salesforce. (2024). 6th Edition of State of the Connected Customer.

-

Statista. (2024). E-commerce Market Forecast Topics.

-

Grand View Research. (2025). UK E-Commerce Market Size & Outlook, 2030.

-

Expert Market Research. (2024). United Kingdom E-Commerce Market Size, Share | Report 2034.

-

IMARC Group. (2025). UK E-commerce Market Size, Share | Statistics Report, 2033.

-

Market Data Forecast. (2025). Europe E-Commerce Market Size, Share, 2033.

-

WP Engine. (2024). Headless Website Architecture Survey. Censuswide survey of over 1,000 respondents.

-

UBS. (2024). Subscription Economy Forecast Report.